Immediate Loans- Get Immediate Cash Advance for Small Emergencies

Money plays an integral role in everyone’s life. Lack of money puts you under a lot of stress. Situation may turn worse when some unplanned financial emergencies enter your life. Therefore, to cope with such difficult times, applying for immediate loans can really help. These are short term loans. They come as a savior in your life when you need it the most. Thanks to these loans you can able to arrange additional money at midst of the month for small unwanted expenses.

These loans are fast and hassle free. But every coin has two sides. These loans are an expensive financial option as they are charged with higher rates of interest. These loans are collateral free and provided for only short time only. These are the reasons behind making them a costly affair for many. So, you are advised to go for these loans only in extreme emergencies. You must know in advance whether you can able to afford such expensive loans or not. If you are not sure about making timely repayment, then you must avoid applying for such loans at all cost. Failed payment or missed payment may turn these loans even more expensive and put you under severe debt trap.

Upon approval of immediate loans you can able to fetch easy financial help that comes anywhere in between AU$100 to AU$1,000. The loaned money is needed to pay off within short time period of 15 to 30 days. Lenders will not ask how you have planned to spend borrowed funds. Feel free to cater any of your short term urgent desires like payment for pending home rent, unpaid phone bills or electricity bills, bank overdraft, small home or car repair expense, handling small unexpected medical bill and other miscellaneous expenses.

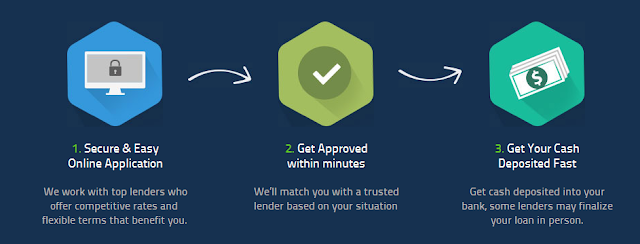

Apply for immediate loans in an easiest and quickest way via online medium. Online loan market is packed with wide network of top lenders who offer these loans at different rates. This means you can negotiate with high interest charges and you must also see APR, cost, rates and fees and other terms of the loan before applying for it. A careful comparison can help you get favorable loan deal that best suits your requirement and budget. Fill in a simple online application form with the desired details on lender’s website and submit it. Lenders will run a credit check to determine your credit worthiness and will take decision on loan approval. Once approved, the money will be directly wired into your bank account.

Henceforth, by simply opting for immediate loan you can able to handle emergencies on time but you need to deal with huge interest rates while taking up such loans.

These loans are fast and hassle free. But every coin has two sides. These loans are an expensive financial option as they are charged with higher rates of interest. These loans are collateral free and provided for only short time only. These are the reasons behind making them a costly affair for many. So, you are advised to go for these loans only in extreme emergencies. You must know in advance whether you can able to afford such expensive loans or not. If you are not sure about making timely repayment, then you must avoid applying for such loans at all cost. Failed payment or missed payment may turn these loans even more expensive and put you under severe debt trap.

Upon approval of immediate loans you can able to fetch easy financial help that comes anywhere in between AU$100 to AU$1,000. The loaned money is needed to pay off within short time period of 15 to 30 days. Lenders will not ask how you have planned to spend borrowed funds. Feel free to cater any of your short term urgent desires like payment for pending home rent, unpaid phone bills or electricity bills, bank overdraft, small home or car repair expense, handling small unexpected medical bill and other miscellaneous expenses.

Apply for immediate loans in an easiest and quickest way via online medium. Online loan market is packed with wide network of top lenders who offer these loans at different rates. This means you can negotiate with high interest charges and you must also see APR, cost, rates and fees and other terms of the loan before applying for it. A careful comparison can help you get favorable loan deal that best suits your requirement and budget. Fill in a simple online application form with the desired details on lender’s website and submit it. Lenders will run a credit check to determine your credit worthiness and will take decision on loan approval. Once approved, the money will be directly wired into your bank account.

Henceforth, by simply opting for immediate loan you can able to handle emergencies on time but you need to deal with huge interest rates while taking up such loans.