Mistakes To Avoid While Borrowing Immediate Payday Loans!

In the urgent financial times, people

can simply rely upon the lending schemes available in the loan market.

There are many lenders who offer the small cash help to working people

in their tough times. Immediate Payday Cash Loans are one such financial

product that allows loan seekers to get small amount for short term in

an easy way. These finances are very helpful to tackle the unexpected

situations but it is must to choose the apt lending scheme to avoid any

trouble in the financial future.

These

services are quite beneficial to opt in tough times as it allows one to

get few hundred bucks simply against their coming salary. No collateral

and flexible terms make it the right choice for working people to

choose at the time of need. But to enjoy the positive lending it is

important to carefully manage the funds and avoid ending up in the large

consequences. A little due diligence while choosing the deal helps to

avoid the unnecessary harsh terms and get the suited lending offer. That

is why; it is advised to take some time in comparing multiple options

and avoid common mistakes to choose the reliable and pocket friendly

service.

1. Choosing Random Loan Product

When choosing small loan, many people are not interested to spend their time in researching for the suited loan scheme. They just choose the random deals as they think every deal is same. But it is not true as terms of very lender vary from other which makes it necessary that you compare multiple options to choose the affordable and reliable lending scheme.

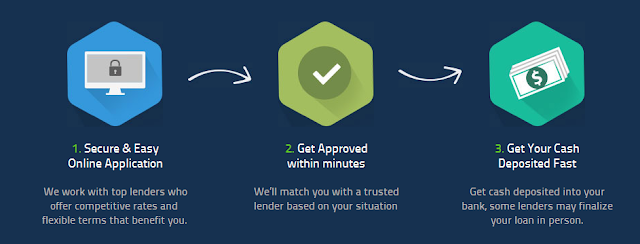

2. Running The Lending Procedure

The lending process of these small Immediate Payday Loans is free from the traditional lending formalities of pledging collateral and faxing number of papers. This makes it convenient for one to follow the lending process. But still before choosing the lender you must consider their process in order to follow it aptly to get quick money in a hassle free way.

3. Limiting Lending Options

You must think that local payday store able to provide you the immediate help with easy terms. But it is not true as there are many lending schemes available online that allow people to swift and easy money from the comfort of their place. Thus, it is must to expand your options in order to pick the most suited monetary deal.

4. Not Reading The Loan Agreement

At certain times, lending offers looks too good to be true. For that it is important that you check every detail of the deal and lender in order to avoid any possibility to fall in lending trap of fraud lender. Reading the fine print of the loan deal is important to make sure you are taking home the right service with right terms that is beneficial for your situation.

1. Choosing Random Loan Product

When choosing small loan, many people are not interested to spend their time in researching for the suited loan scheme. They just choose the random deals as they think every deal is same. But it is not true as terms of very lender vary from other which makes it necessary that you compare multiple options to choose the affordable and reliable lending scheme.

2. Running The Lending Procedure

The lending process of these small Immediate Payday Loans is free from the traditional lending formalities of pledging collateral and faxing number of papers. This makes it convenient for one to follow the lending process. But still before choosing the lender you must consider their process in order to follow it aptly to get quick money in a hassle free way.

3. Limiting Lending Options

You must think that local payday store able to provide you the immediate help with easy terms. But it is not true as there are many lending schemes available online that allow people to swift and easy money from the comfort of their place. Thus, it is must to expand your options in order to pick the most suited monetary deal.

4. Not Reading The Loan Agreement

At certain times, lending offers looks too good to be true. For that it is important that you check every detail of the deal and lender in order to avoid any possibility to fall in lending trap of fraud lender. Reading the fine print of the loan deal is important to make sure you are taking home the right service with right terms that is beneficial for your situation.