Reasons why not all your credit reports show the same credit score:-

In today’s time, managing your financial requirements without the help of loans is quite impossible.

Whenever there is a shortage of funds, the most common choice is to get a loan. The health of your credit report plays a crucial role in getting your loan application accepted or rejected.

Hence, it is utmost important for you to have a favourable credit profile. Borrowers face a difficult situation when their report shows different scores from different bureaus.

This variation in scores may lead to problems in getting a loan. There are several factors that cause this disparity in your score that you get from various bureaus.

Varied scoring models:

Other than a few leading agencies, many more have come up who are offering services related to credit scores. All these agencies have a different procedure to calculate your score. Lenders also have their own method of calculating your score that helps them decide whether to lend you the money you requested.

Time of calculation:

Credit bureaus and other agencies do not determine your score at the same time. It is done in different months of the year. Hence, you are most likely to see different credit scores even if you get your reports the same day.

Information:

It is the information in your file that is the base of computing the score. A credit bureau takes into account your details from the file. As and when a lender informs a bureau, the file is updated. Now, if the information reaches a bureau late, it will take time to update it. Consequently, the credit reports will show discrepancy.

Score range:

Every credit bureau has its own range of score. The score in credit report is one of the key factors in your loan application getting rejected or approved. Generally, a score on the higher side is favourable for you because it is preferred by lenders.

The involved risk in lending the money goes down as the points in your credit score goes up. However, the range of score is not uniform with all the agencies.

Un-associated lenders:

The operating credit bureaus are legally bound to update information regarding credit history of citizens.

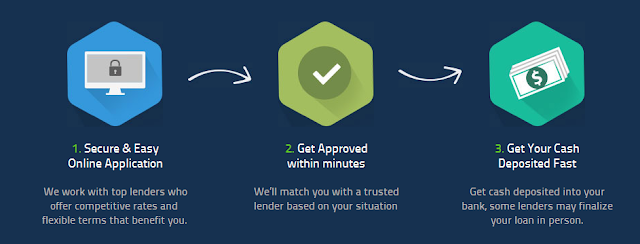

Nevertheless, not every lender is associated with all the bureaus. As a result, even if you made a timely repayment to the lender, not all credit reports will show an improved credit score. easily apply for Quick Payday Loans